Single Mother Crisis

Being a parent is hard, but it is infinitely harder when you are a single mother. The financial concerns faced by single mothers set them apart in a league of their own. This group of resilient individuals not only shoulders the responsibilities of raising children but also grapples with unique economic challenges that can significantly impact their family’s future. Single mothers face a myriad of financial hurdles that distinguish their experiences from those of their coupled counterparts. Let’s break down some of the issues that exacerbate situations for single mothers.

Opportunity gap

In many societies, single motherhood is still stigmatized, leading to potential discrimination in the workplace and limited career advancement. As a result, single mothers often find themselves navigating a narrower field of employment opportunities, exacerbating their financial instability.

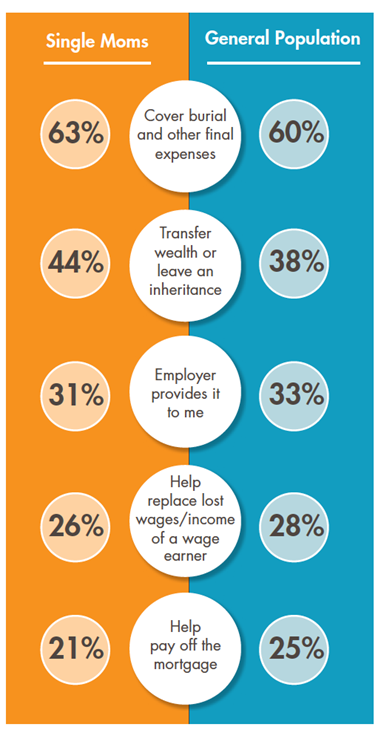

Just look at this recently conducted survey that reflects how much more extreme the financial concerns faced by single mothers are compared to the rest of the population-

Wealth Gap

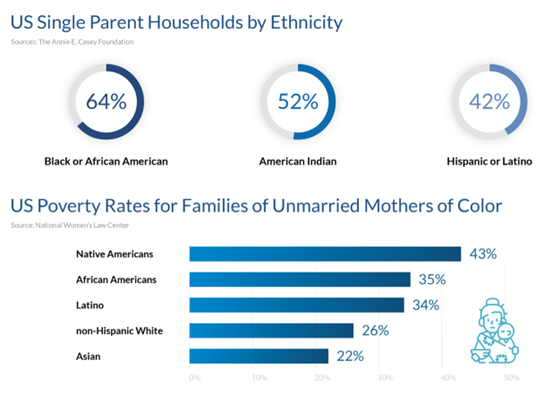

First and foremost, wealth is a paramount factor for housing and food security, and financial well-being. The wealth gap between single mothers raising children and a family with both parents present is unimaginably huge, and it varies considerably by race and ethnicity. Wealth inequality compounds the financial concerns of single mothers, as they typically have lower net worth compared to their married counterparts. Limited access to assets and homeownership can perpetuate financial instability, hindering the ability to build generational wealth.

This disparity not only affects the day-to-day expenses but also limits the ability of single mothers to invest in their children’s future through education, extracurricular activities, and other enriching experiences. The grim reality faced by many single mothers becomes clear with one look at this statistics-

Single white mothers had $46,000 in median wealth in 2019, whereas single Black and Hispanic/Latina mothers had about $4,000. Single white mothers thus had about 11 times more median wealth, affording them a more comfortable cushion when dealing with unanticipated events like the pandemic. In 2020, Black and Hispanic/Latina women (ages 25-54) were more likely to be single mothers of children ages 0-17 than were white women; the likelihood of being such a mother was 26%, 19% and 11%, respectively. Hence, the economic difficulties are compounded for a single mother of color in the United States-

Moreover, the absence of a second income stream means that single mothers must stretch their financial resources further, covering the costs of housing, education, healthcare, and other essentials on a single paycheck. This heightened financial strain can impact their ability to provide a comfortable and enriching environment for their children, setting the stage for a cascade of challenges that may impede their kids’ success.

Education Gap

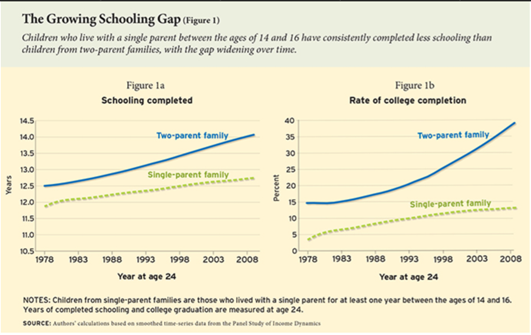

The single most significant concern for single mothers is the impact of their financial struggles on their children’s education. Education is hailed as the great equalizer, but the financial limitations single mothers face can hinder their ability to provide the same level of educational opportunities as two-parent households. From access to quality schools to extracurricular activities that foster well-rounded development, these opportunities may be financially out of reach for many single-parent families. Current research and studies in the field of education find a strong negative relationship between living with a single parent and educational attainment for children.

The education gap between young adults who lived in single-parent families and those who lived in two-parent families widened substantially between 1968 and 2009. In 2009, young adults who spent time living in single-parent families had completed 1.32 fewer years of schooling than their peers from two-parent families. By the age of 24, individuals who live in single-parent families as teens receive fewer years of schooling and are less likely to attain a bachelor’s degree than those from two-parent families.

According to the National Center for Children in Poverty, children in single-parent families, especially those led by mothers, are more likely to experience poverty and its associated challenges, including limited access to quality education and extracurricular activities. The financial challenges faced by single mothers also create a cycle of intergenerational poverty. Without adequate resources, children may lack the necessary support and opportunities to break free from economic hardship. Limited access to quality education, extracurricular activities, and a stable home environment can contribute to a disadvantage that persists into adulthood, further perpetuating the cycle.

The Solution

If anyone claims to have a single solution to the impossible financial difficulties faced by single mothers, they are lying. While there can be no financial panacea for single moms, Life Insurance can make things significantly better, more specifically it can make a tangible difference in the lives of children of single mothers and their families. Here is how-

Income Replacement:

The primary breadwinner in a single-parent household is often the single mother. If she were to pass away unexpectedly, her income would be lost, leaving her children in a financially vulnerable position. Life insurance serves as a financial safety net, providing a tax-free lump sum that can replace lost income and help maintain the family’s standard of living.

Debt Coverage:

Single mothers may have various financial responsibilities, including mortgage payments, car loans, and other debts. Life insurance proceeds can be used to cover outstanding debts, ensuring that these financial obligations do not become burdens for the surviving family members.

Education Expenses:

Planning for the educational future of their children is a priority for many single mothers. Life insurance benefits can be earmarked for covering educational expenses, such as college tuition, ensuring that the children have the financial resources needed to pursue their academic goals.

Childcare and Household Expenses:

Single mothers often juggle multiple responsibilities, including childcare and household management. Life insurance proceeds can be used to cover the costs of hiring help or providing additional support to ensure that the family’s daily needs are met, even in the absence of the primary caregiver.

Estate Planning and Wealth Transfer:

Life insurance can be integrated into an overall estate plan, serving as a means of transferring wealth to the next generation. This can include creating a trust to manage the funds for the benefit of the children, ensuring that they have financial security into adulthood.

Guaranteed Insurability:

Obtaining life insurance at a younger age is generally more affordable. By securing a life insurance policy early, single mothers can lock in lower premiums, providing long-term financial protection for their families. It also ensures that insurability is not compromised by any future health issues.

Peace of Mind:

Life insurance not only provides financial protection but also peace of mind. Knowing that there is a financial safety net in place can help single mothers focus on their daily responsibilities without the constant worry about what might happen to their family’s financial future in the event of their untimely death.

Compared to the rest of the general population it is immeasurably MORE IMPORTANT that single mothers own at least some form of life insurance. Look at a real life survey result as to why single mother bought life insurance –

It is completely understandable that other priorities regularly get in the way of getting a life insurance policy. Especially more so because single moms are busy living hand to mouth, day to day and it is more important that kids are taken care of today before they can think of their future. In simpler words, short term financial concerns stomp on long term sustainable financial planning.

Take a look at the reasons why they DON’T have life insurance, as you can see no single mother thought they did not need life insurance, it was because they had to prioritize today more than their future-

While we can’t do anything if you think you are immortal and will be there to take care of your kids forever, we can surely help you take care of the first four obstacles. The goal of agents of Octans Insurance is to find the best coverage at the cheapest possible price. We promise you can Afford life insurance, just by giving up one night out a month. Or a few Starbucks visits. We don’t want you to buy life insurance you will stop paying for after a month. Instead, we will find you a policy that will not tax your already strained financial situation. If you don’t believe that’s possible, give us a call for a quote, it does not cost you anything!

Our agents at Octans Insurance are dedicated to helping our clients understand the pros and cons of different insurance policies. We believe in educating our clients about the value of life insurance before you can make a decision that might change the financial trajectory of your family for generations to come.

We promise to be there for your family on their worst days when you will no longer be there to take care of them financially. We understand the hectic life single mothers lead, we respect your time so 5 minutes of your time will be enough for us to explain the basics to you. Then, you can decide for yourself whether to make a difference in your children’s lives and give them a better future.

For more info –

https://www.stlouisfed.org/on-the-economy/2022/may/single-mothers-slim-financial-cushions