What the Inflation Reduction Act of 2022 Means for Medicare

On August 16, 2022, the Inflation Reduction Act (IRA) of 2022 was signed into law. This government reconciliation bill promised to fund environmental efforts, close tax loopholes, work to lower inflation, and reduce health care costs under the Medicare program. The changes this bill brought has the potential to save Medicare insurance beneficiaries thousands of dollars annually.

Unless directly cited elsewhere, all facts and figures from the bill can be found directly in the legislative text of the Inflation Reduction Act of 20221 or the topline messages for the drug pricing reforms2.

The Medicare Program to Negotiate Certain Drug Prices

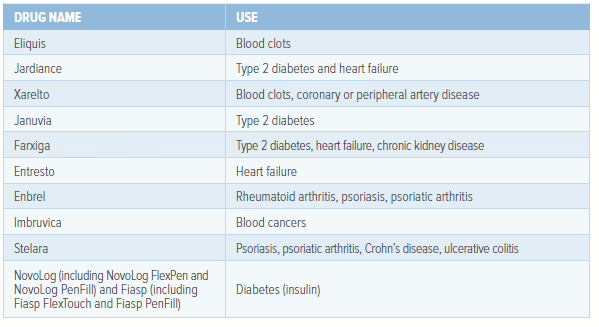

Starting in 2026, the Medicare program will be allowed to negotiate pricing on 10 drugs covered by Medicare Part D. Additionally, the Medicare program will be able to start negotiating prices for drugs covered under Medicare Part B in 2028. This will increase each subsequent year until 2029, when the Medicare program will have 60 total drugs with negotiated prices — 10 Medicare Part D drugs in 2026, 15 more Part D drugs in 2027, 15 Medicare Part B and Part D drugs in 2028, and 20 Medicare Part B and D drugs in 2029. These medications’ prices will be finalized closer to the kickoff date.

The first 10 of these medications were:

In January 2025, CMS announced the next 15 Part D drugs that would be applicable for negotiations

in 2027. They were:

Insulin Price Capped in Medicare

One essential drug with a new price implemented outside of the negotiations is insulin. The bill capped the monthly price of insulin at $35. Prior to this, the cost of insulin ranged from $45 to $1,000 each month.

All Vaccines Covered Under Medicare

The Inflation Reduction Act of 2022 also opened the possibility of preventive vaccinations to be covered under the Medicare program. Previously, Medicare insurance covered vaccines for COVID-19, the annual flu, and pneumonia, while vaccines for Hepatitis A and B or shingles are only covered in certain circumstances or by Medicare Part D. But now, all vaccines will be zero cost.

New Medicare Out-of-Pocket Drug Insurance Costs Cap

Perhaps the most significant change of all is the new cap on out-of-pocket drug costs for Medicare insurance beneficiaries.

As a result of the IRA, the out-of-pocket limit for Part D costs will be fixed and set annually. In 2020, around 1.4 million Medicare Part D enrollees3 had out-of-pocket costs of $2,000 or more. Beneficiaries will also have the option to break their out-of-pocket costs into affordable monthly payments.

Other Part D Adjustments

There were two other major changes and effects on Medicare Part D from the Inflation Reduction Act. First, the IRA is capping the annual growth of Medicare Part D premiums to six percent between 2024 and 2030. Furthermore, the IRA will be expanding access to the Part D Low-Income Subsidy by eliminating the partial subsidy level. This will allow anyone making 150 percent of the Federal Poverty Level to utilize this subsidy and lower their out-of-pocket costs even more.

You can read more about the timeline when each facet of the IRA will come into effect below (graphic courtesy of the Kaiser Family Foundation).

Read more:

1 The Senate Democratic Caucus. H. R. 5376 – https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_ of_2022.pdf

2 The Senate Democratic Caucus. FY22 Budget Reconcilliation – https://www.democrats.senate.gov/imo/media/doc/topline_ messages_for_senate_prescription_drug_pricing_reforms__fy22_budget_reconciliation.pdf

3 KFF. How Will the Prescription Drug Provisions in the Inflation Reduction Act Affect Medicare Beneficiaries? – https://www. kff.org/medicare/issue-brief/how-would-the-prescription-drug-provisions-in-the-senate-reconciliation-proposal-affect-medicare-beneficiaries/#table

Not affiliated or endorsed by Medicare or any government agency.